- Bobby Jindal « Tax Reform Plan

October 7, 2015

Governor Jindal said, “My tax plan lowers the tax bracket for every American, and it dramatically simplifies the tax code for every American. To grow the American economy we must reduce our tax burden and make taxes simpler. My plan has only three rates – 2 percent, 10 percent, and 25 percent. Most Americans will be in the 10 percent bracket.

“Most Republican plans brag about the idea that they will allow about half of all Americans to pay zero federal taxes. I think that is a terrible mistake. Again, most Republican plans do not require the lowest wage earners to pay anything, and some basically require half of Americans to pay zero federal taxes.

“We have come to the point in this country where far too many Americans believe that money grows on trees in Washington. They do not seem to get the fact that our government has no money other than what it takes from our citizens. President Obama has nearly doubled our national debt.

“We simply must require that every American has some skin in this game. If we have generations of Americans who never pay any taxes, it will be very easy for them to turn a blind eye to absurd government spending and to continue to allow our government to bankrupt our nation.

“There is great strength in shared sacrifice. My plan only asks 2 percent from the bottom bracket but that may be the most important 2 percent in the whole plan. It reestablishes the idea that in America everyone is expected to help row the boat. Now some people may have a bigger oar and some smaller but you keep your oar in the water along with everyone else.

“The liberal Democrats will hate this plan, and they will claim that it is not ‘fair.’ Remember this about socialism - it is fair. In socialist economies, everyone is poor, and therefore all but the ruling class suffer equally.

“The genius of America is that hard work and ingenuity are rewarded and enable people to succeed and make their own way in life. Independence, not dependence, is the root of the American Dream. It’s time we had the guts to say so in public. There is dignity in work. Work should be embraced not avoided. Earned success increases personal happiness in a way that unearned success does not, and never will.”

Jindal Unveils Tax Reform Plan: Everybody Has to Have Some Skin in the Game

BATON ROUGE, LA – Governor Jindal today unveiled a new tax reform plan for America that flattens the tax code and requires every American to have some skin in the game by paying something. The plan neuters the IRS and ends the “gotcha game” of tax code compliance that traps average people in confusing regulations. The plan also eliminates the corporate tax in America and reduces the amount of money the government can spend to help grow the economy and create jobs. See the plan summary here.Governor Jindal said, “My tax plan lowers the tax bracket for every American, and it dramatically simplifies the tax code for every American. To grow the American economy we must reduce our tax burden and make taxes simpler. My plan has only three rates – 2 percent, 10 percent, and 25 percent. Most Americans will be in the 10 percent bracket.

“Most Republican plans brag about the idea that they will allow about half of all Americans to pay zero federal taxes. I think that is a terrible mistake. Again, most Republican plans do not require the lowest wage earners to pay anything, and some basically require half of Americans to pay zero federal taxes.

“We have come to the point in this country where far too many Americans believe that money grows on trees in Washington. They do not seem to get the fact that our government has no money other than what it takes from our citizens. President Obama has nearly doubled our national debt.

“We simply must require that every American has some skin in this game. If we have generations of Americans who never pay any taxes, it will be very easy for them to turn a blind eye to absurd government spending and to continue to allow our government to bankrupt our nation.

“There is great strength in shared sacrifice. My plan only asks 2 percent from the bottom bracket but that may be the most important 2 percent in the whole plan. It reestablishes the idea that in America everyone is expected to help row the boat. Now some people may have a bigger oar and some smaller but you keep your oar in the water along with everyone else.

“The liberal Democrats will hate this plan, and they will claim that it is not ‘fair.’ Remember this about socialism - it is fair. In socialist economies, everyone is poor, and therefore all but the ruling class suffer equally.

“The genius of America is that hard work and ingenuity are rewarded and enable people to succeed and make their own way in life. Independence, not dependence, is the root of the American Dream. It’s time we had the guts to say so in public. There is dignity in work. Work should be embraced not avoided. Earned success increases personal happiness in a way that unearned success does not, and never will.”

Governor Jindal’s tax reform plan has FOUR overarching goals:

- Governor Jindal’s plan requires every American to have skin in the game. Every citizen needs to help row the boat, even if only a little. The idea that half of American wage earners would pay no taxes at all only reinforces the fact that we are creating two classes in America, the tax paying class and the dependent class. Instead of fewer people paying more taxes, more people should pay fewer taxes.

- Governor Jindal’s plan neuters the IRS, ending the “gotcha game” of tax code compliance and getting Washington out of our wallets. At four million words, it’s no wonder average people get trapped in a web of confusing regulations that read like an instructional manual for your life and your money: buy an electric car, don’t save money to give to your children, only one spouse should work. Let’s stop spending billions of taxpayer dollars to collect taxpayer dollars so that the IRS can make decisions with your money for you.

- Governor Jindal’s plan taxes CEOs rather than companies. By eliminating the corporate income tax, this plan recognizes that corporations will always have better paid lobbyists than the average person. Make no mistake, corporations are not people, they are businesses, which create jobs and wealth; at present, the tax code pushes them to create these jobs and this wealth outside of America. Let’s allow business to reinvest and grow in the US, rather than inverting profits to other countries and taking on risky debt to finance activities.

- Governor Jindal’s plan reduces the amount

of money the federal government will be able to spend. President

Obama

has

nearly

doubled

our

national

debt.

It

is

now

over

$18

trillion

and

is

the

largest

debt

in

the

history

of

the

world.

The

only

way

to

shrink

the

size and influence of Washington is

to starve it.

Over 10 Years, Governor Jindal’s Tax Reform Plan Will Produce The Following Results:

- GDP

will

grow

by

14.4%,

or

on

average

1.4%

per

year

on

top

of

the

projected

2%

base

growth.

- Taking into account other pro-growth reforms that return capital to the economy, this plan is part of an overall plan to get GDP growing at over 4% per year.

- Capital stock will grow by 38.3%

- Wage rate will grow by 8.7%

- 5.9 million jobs will be added to the economy

- Federal revenue will be cut by 22% or $9 trillion

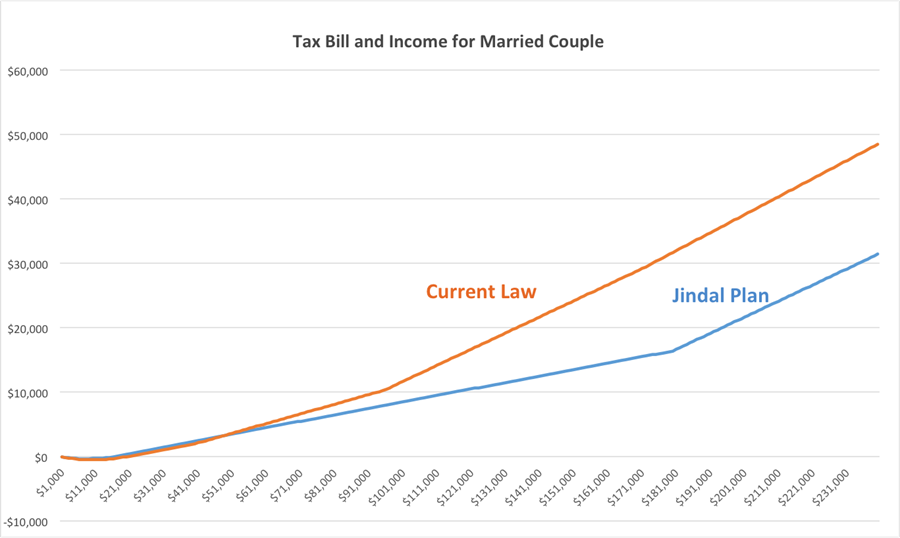

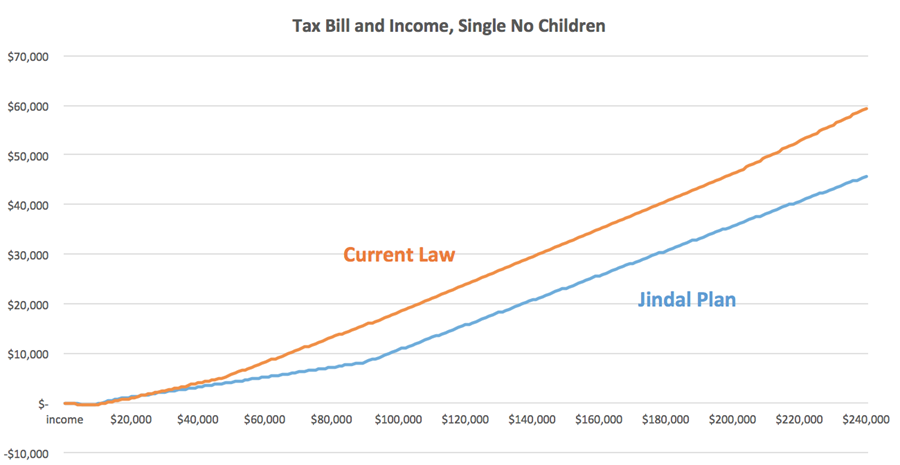

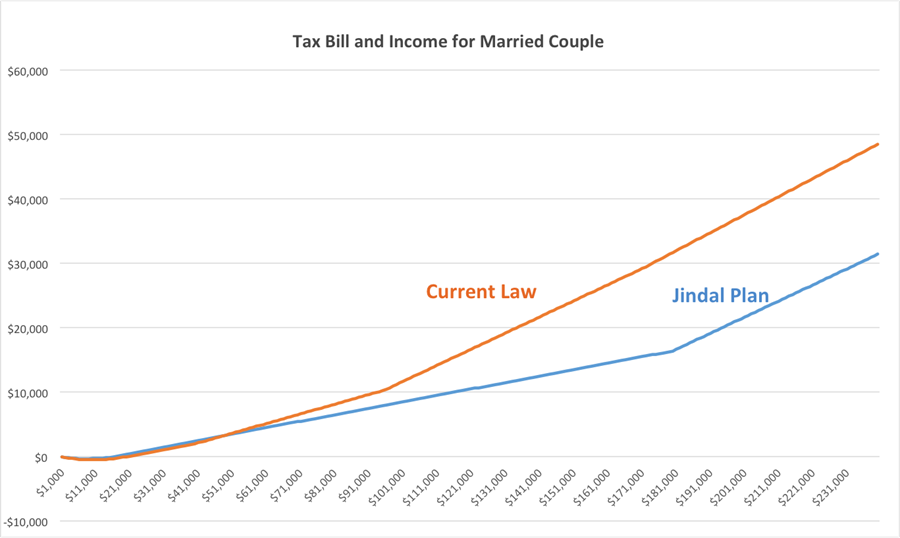

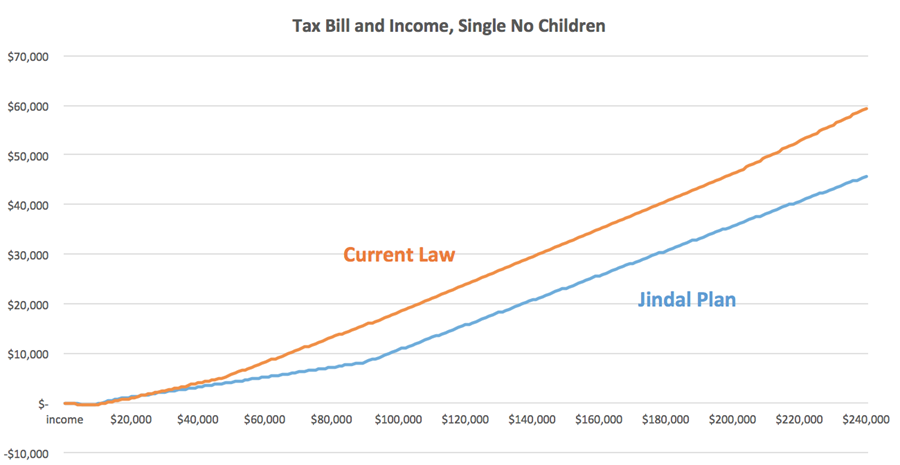

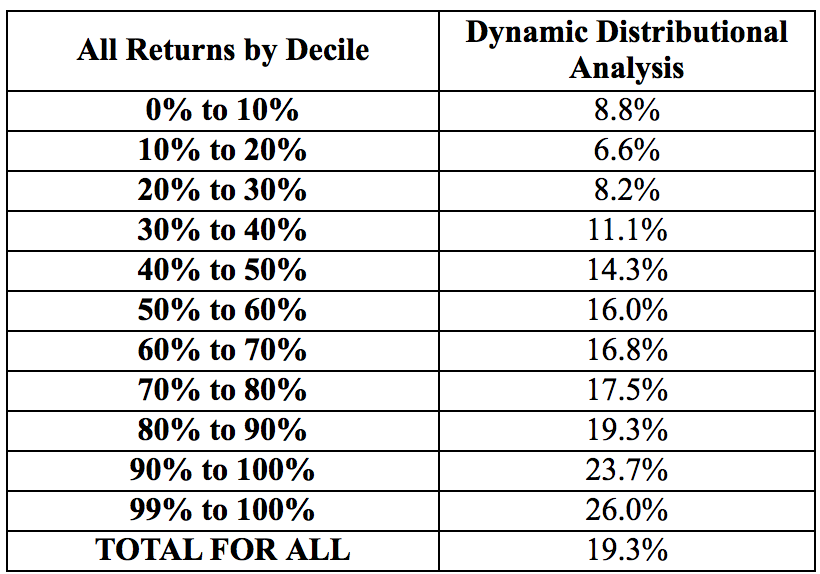

Governor Jindal’s tax reform plan will significantly flattens the distribution of taxes across all income brackets.

Personal Income Tax Changes In Governor Jindal’s Tax Reform Plan:

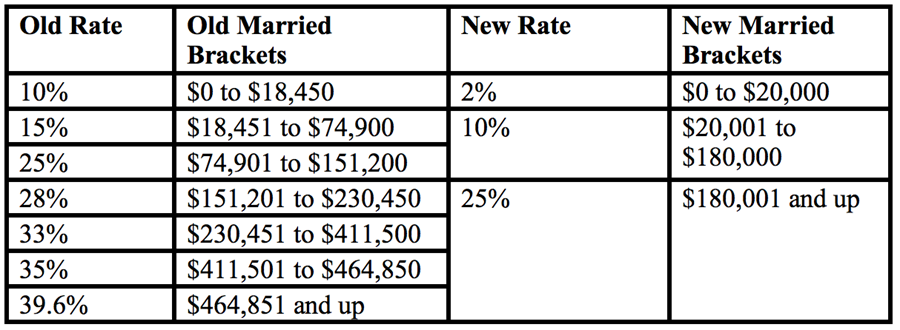

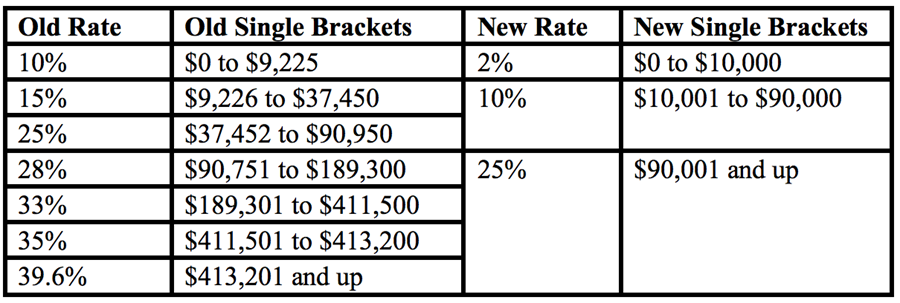

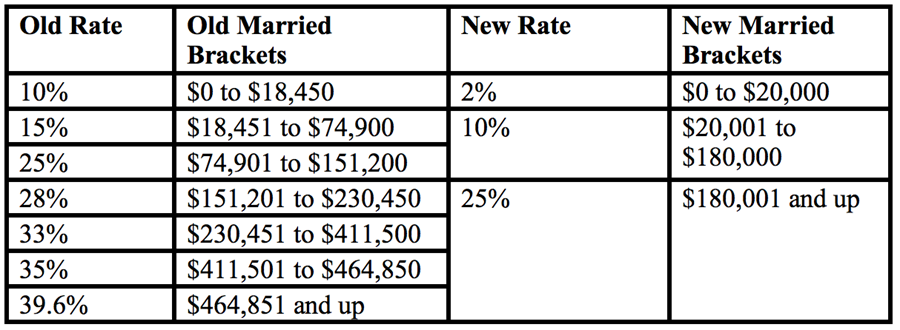

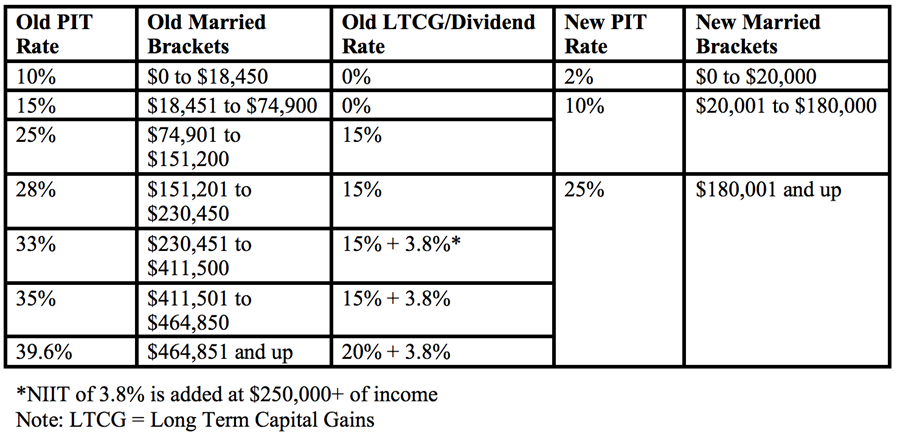

- Reduce brackets from 7 to 3 and simplify filing status to two: single and married. Maintain widower filing jointly.

- Eliminate

the

personal

exemption,

the

standard

deduction

and

all

itemized

deductions,

except

for

five:

- The charitable contributions deduction with no changes.

- The Earned Income Tax Credit, transferred over to the payroll tax where it will be easier to audit, administered by employers, and more appropriately mirror income

- The Mortgage Interest Deduction, capped at interest on mortgages worth up to $500,000 instead of $1 million as is allowed today

- Replace the exclusion for employer-based health insurance with a standard deduction for health insurance costs whether they are provided by the employer or purchased by an individual

- A nonrefundable dependents credit that accounts for household size of dependents: children under the age of 18, elderly making less than $5,000 over the age of 65, and the disabled.

- These remaining deductions would have no PEP or Pease limitation, while imposes arbitrary income caps on the value of deductions.

- Eliminate the Alternative Minimum Tax, which increasingly penalizes the middle class.

- Address

the

marriage

penalty

by

doubling

income

brackets

for

married

vs.

individual

filers

and

allowing

married

filers

to

chose

how

to

file.

Currently,

the

married

brackets

are

not

double

the

single

brackets, which means that a second working spouse can increase the

couple’s tax rate and lower overall after-tax income.

- For example, John Doe currently makes $65,000. He falls into the 25% bracket as a single man and the 15% bracket as a married man. If his wife, Jane Doe, starts to work and makes only $8,000 a year at a part time job, they would still fall into the 15% bracket as a married couple and pay $1,200 more in taxes. If Jane gets a fulltime job making $50,000 per year, now Joe and Jane fall into the 25% bracket, and they have to pay for childcare. So they pay 12,500 more in taxes plus an additional $5,000 per year in childcare.

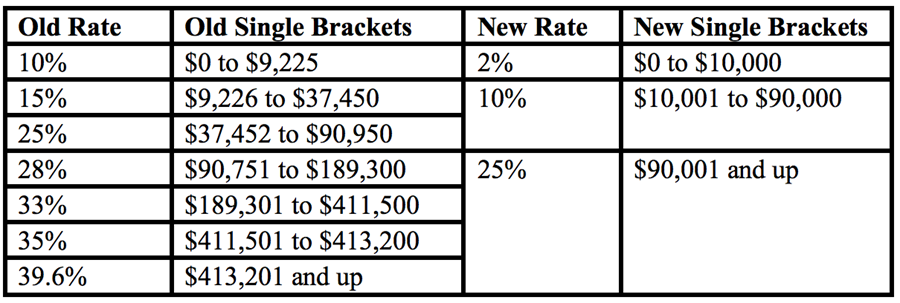

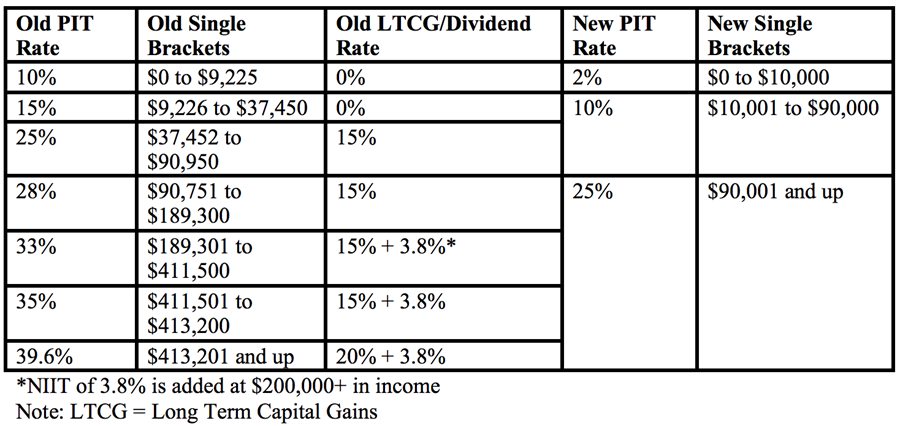

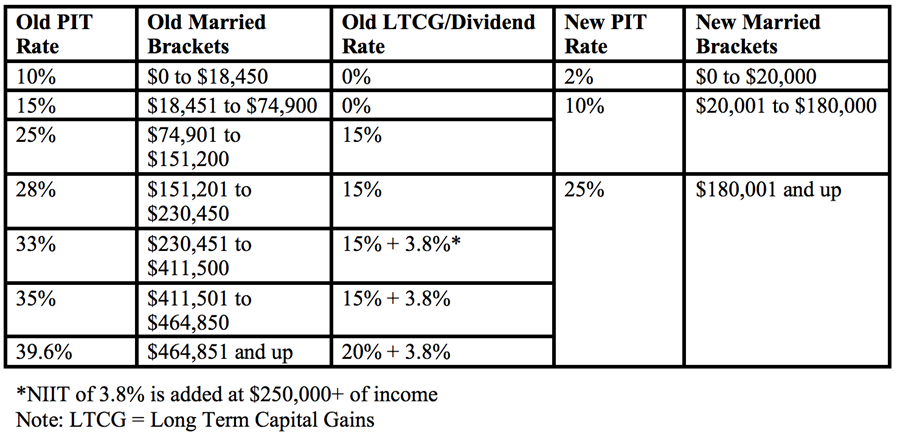

New Rates/Brackets In Governor Jindal’s Tax Reform Plan:

- Create

a

Tax-Free

Savings

Account

up

to

$30,000

per

year.

- This is another way to get at a consumption based system by taxing less income that is not spent. It also helps remove the bias towards immediate consumption by equalizing the cost of spending now vs. spending later.

- Existing

retirement

and

tax-free

savings

accounts,

such

as

those

for

college,

would

be

grandfathered

in,

or

could

be

rolled

over

into

the

new

TFSA.

Any contributions to these

accounts would be subtracted from the $30,000 cap and unused

contribution value could be rolled into future years. Roth accounts

would remain separate from the TFSA completely in order to avoid double

taxation.

- For example, an individual who makes the maximum contribution to their IRA ($5,500) in a single year, would be able to make an additional $24,500 contribution to their TFSA.

- The $30,000 cap would not apply to 529 plans, which currently do not have an annual contribution limitation.

All

taxpayers

see

an increase on a dynamic basis in income.

Proposed Corporate Income Tax Changes In Governor Jindal’s Tax Reform Plan:

- End double corporate taxation by

taxing

all

income

at

the

same

rate

and

only

once.

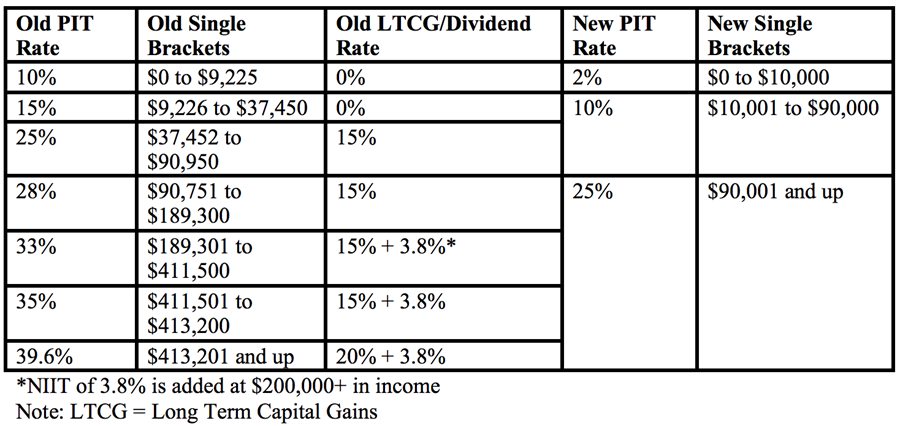

- This proposal eliminates the corporate income tax, taxes capital gains and dividends as ordinary income and eliminates the Obamacare Net Investment Income Tax (NIIT) of 3.8%.

- Corporations spend millions of dollars on “tax planning” to avoid the U.S.’s corporate income tax, which is the highest in the developed world. Instead of spending millions of taxpayer dollars on corporate compliance, we invite business to reinvest back in the American economy and shift the single layer of corporate taxation to CEOs and corporate executives.

- By default, this removes the deductibility of interest from the CIT, which encourages companies to finance with debt.

- It also puts pass through entities like partnerships, LLCs, and s-corps on a level single playing field, and includes immediate expensing of capital investments for these entities.

- Moves to a territorial taxation system. A

one-time

8%

forever

tax

rate

would

be

imposed

on

income

earned

abroad

prior

to

the

law

change.

- Instead of incentivizing American companies to sell to foreign companies to avoid our corporate tax code, do complicated inversions, or keep corporate income abroad by penalizing them for bringing it home, we should be encouraging American companies to reinvest in our economy.

Additional Changes In Governor Jindal’s Tax Reform Plan:

- Estate

and

gift tax are eliminated.

- These taxes penalize parents that save to pass on property or assets to their children.

- Repeals

all

of Obamacare taxes

- Obamacare raised nearly $500 billion in taxes on individuals and companies.

###