- Jeb Bush « Economic Policy Speech

Former Gov. Jeb Bush (R-FL)

Economic Policy Address

Morris & Associates

Garner, NC

September 9, 2015

“Today as we meet, America’s economy is barely moving forward and American working families are falling behind. We’ve had six full years of tax increases, endless new regulation, vast new federal programs, and eight trillion dollars borrowed and spent. And what has it gotten us? This so-called “new normal” of slow growth, flat wages, and millions of men and women – often people in the prime of their working lives – who’ve lost all hope of a good, full-time job.

“It’s easy for politicians and academics to go on and on about this “new normal” in America, and how we all might just have to get used to it. They talk as if it is the best our country can do, when in truth it is just the best the progressive liberals can do. And to state the obvious, the new normal is not good enough, and not even close.

“Hillary Clinton doesn’t believe that we can grow faster than two percent, because she doesn’t believe in your ability to rise to the challenge. This is a debate I welcome, because the difference between the Democrats’ new normal, and my vision for high, sustained economic growth is pretty simple to state. The new normal is more businesses going under than starting up, which is where we are right now.

“My plan for the entire economy will create a true revival of the private sector, and 19 million new jobs. The new normal is a comfortable ride for affluent people living on their portfolios. My plan will help those who live on their paychecks and who haven’t seen a raise in a while. And it means the American dream will be possible for millions who have forgotten what it looks like.

“The point is that some numbers matter a great deal, and our nation’s economic growth rate is one of them. The difference between 2 percent growth and 4 percent growth is this: At 2 percent, we stay where we are, with millions on the sidelines falling behind. At 4 percent, we grow at a pace that lifts up everybody, and there is no excuse for not trying.

“We need to jump-start our economy, and we can do that by fixing our broken tax code. It’s a disaster. We all know it. Eighty thousand pages. Two otherwise identical taxpayers could have hugely different tax bills, because of all the deductions, credits, and exclusions that apply to some but not to all. It’s a tax code only an army of accountants and lobbyists would love, because they’ve written it. It’s full of special favors, carve-outs, phase-outs and subsidies – that you pay for, one way or another.

“Of all the terrible things that can be said about our tax code – and I can think of a few – the worst is probably this: It punishes people for doing things we should encourage and rewards people for doing things that may not be so good. It taxes paychecks hard but gives companies a write-off for debt. The current tax code makes it easier to borrow than to build. I believe it’s time we build for the future, not borrow from it – so I am here today to explain how I want to fix our broken tax code.

“My plan works whether you’re on Main Street or Wall Street. No special favors. No special breaks. Fixing the tax code will take constant attention and effort. And I know what that requires. Because I did it when I was governor. I cut taxes every year I was in office, totaling 19 billion dollars, and we didn’t even have an income tax to cut. We were one of two states to see our credit rating go up to Triple A. Compare that to the sorry state of affairs in Washington D.C., where we sadly have seen a downgrade. And our economy blossomed, growing at 4.4%. Florida created 1.3 million new jobs. Household incomes rose 1,300 dollars. And that prosperity was shared. That is a record I plan to repeat in Washington D.C.

“Here are the key elements of the plan that I will submit to Congress and sign into law as the Reform and Growth Act of 2017. Let’s start with personal taxes. Taxes should be lower, simpler, fair, and clear.

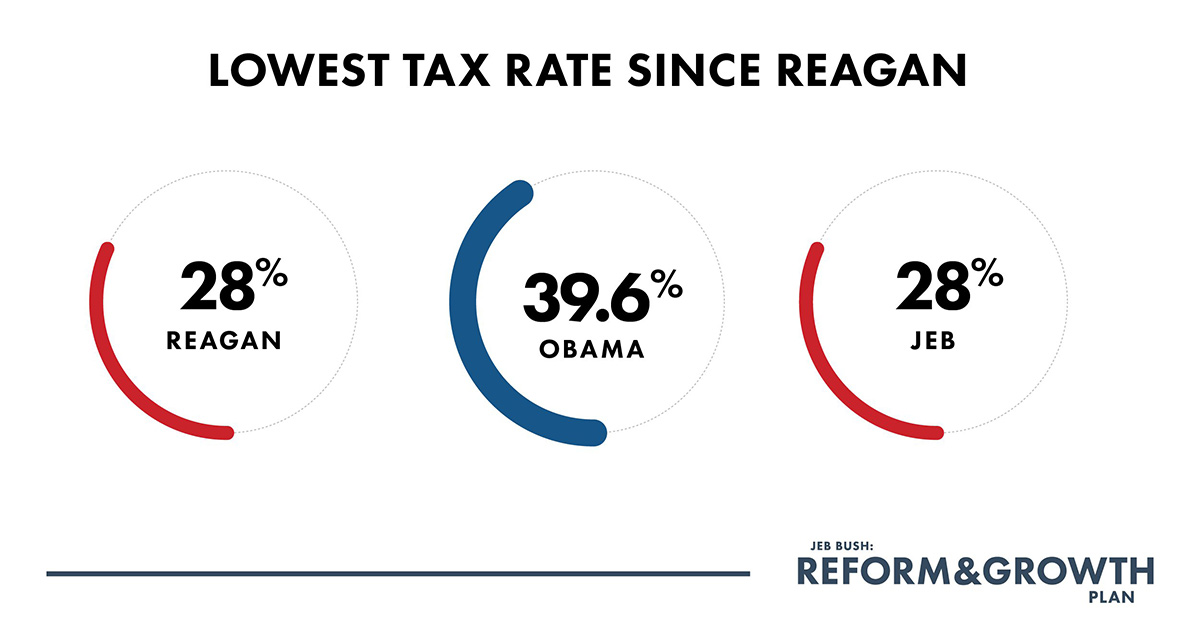

“We will start by reducing the number of tax brackets from seven to three. The new rates will be 10, 25, and 28 percent. With the highest rate set at 28 percent, we will have returned to the structure enacted in President Ronald Reagan’s monumental and successful 1986 tax reform. It worked before, and it can work again now.

“Next, we will nearly double the standard deduction – which roughly two-thirds of all tax filers claim. Retire the Alternative Minimum Tax, which is a phantom tax increase on millions of Americans every year. Expand and reform the Earned Income Tax Credit. Eliminate the worker’s share of Social Security tax for seniors who have already sent enough of their paychecks into the system. End the Marriage Penalty. And End the Death Tax once and for all. We will limit the amount of deductions that wealthy people and other itemizers can take, other than charitable contributions. Finally, we will improve the climate for savers in this country by removing the 3.8 percent Obamacare savings tax. And we will cut the rates on capital gains back to 20 percent, the rate they were at when President Clinton was in office.

“I think we all know the same old song the left will sing about this plan. So let’s get the record straight up front. Under my plan tax bills will be going down, but those earning $200,000 or more will bear a greater share of our income tax burden than they do today. So the top 5% will bear a greater share. And the top 10% as well.

“Meanwhile, here’s the impact on working families: They are already nickled and dimed by a government that taxes everything under the sun – sales taxes, gas taxes and property taxes. So under my plan, a family of four with an income below $40,000 won’t pay any income taxes at all.

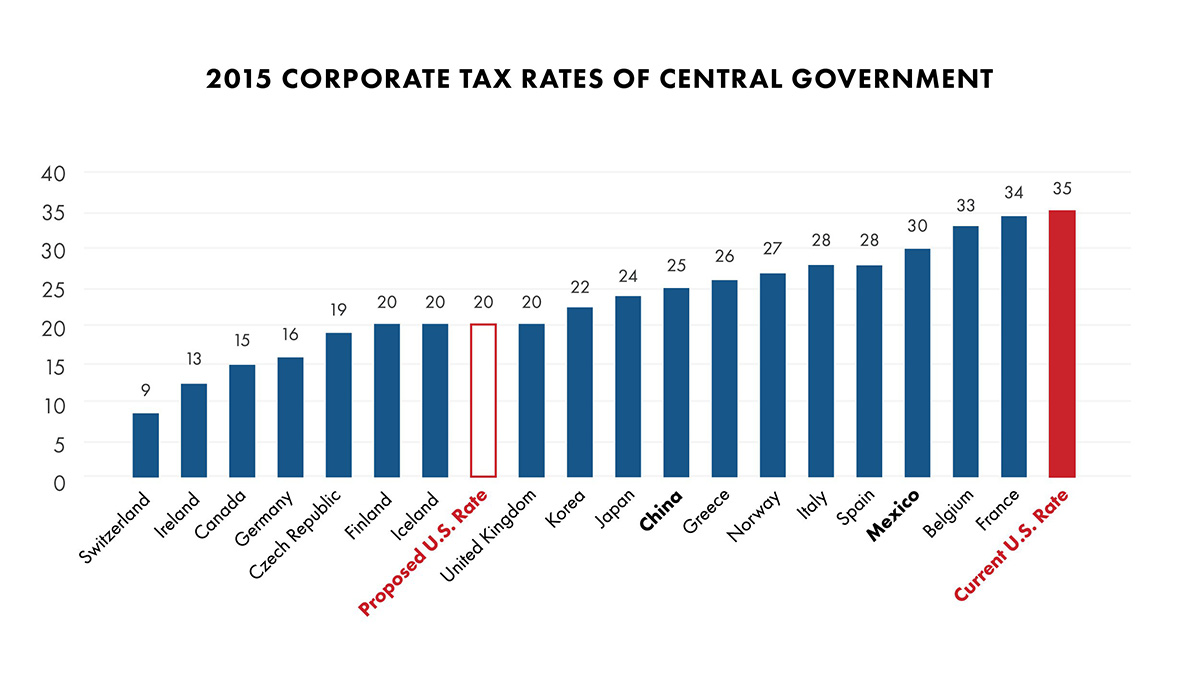

“Taken together, this plan moves money out of the hands of the politicians in Washington, and gives it back to hard-working Americans like you who will use the money they save for their own priorities, not the government’s. And while we help make it easier for individuals and families to make ends meet, we’re going to help American companies compete as well. For too long, U.S. businesses have operated with the highest tax rate in the industrialized world. It’s no wonder that so many have moved overseas – and taken thousands of jobs with them.

“There’s a simple way to fix this problem. First, we will bring the corporate tax rate from 35 percent, the highest corporate rate in the industrial world, down to 20 percent, which is below China’s. Next, we will end the extra taxation of profits earned overseas. We will stop the practice, which most of the world has already abandoned, of worldwide taxation. We will allow the 2 trillion dollars now held overseas to come home with a one-time tax.

“These moves will end the insidious trend of what they call inversions – where small overseas companies buy bigger U.S. companies so that both can enjoy the lowest possible tax rate – costing us jobs and tax revenue. For once, the U.S. will be a low-tax place to do business and create high-wage jobs.

“Finally, we will put Main Street and Wall Street on even footing. We will allow businesses to fully deduct new capital investment in the first year – something which will help businesses buy equipment, build factories and invest in other growth.

“At the same time, we will take away the tax deductions for corporate borrowing. If your business model depends on heavy debt and leverage, that’s your choice. Under my plan, you’ll pay for it. Taken together, this plan will bring tax revenue and high-wage jobs back to America where they belong.

“Now those on the left, and even some people who call themselves Republicans, will tell you that to save U.S. jobs, we have to throw up a bunch of walls and tariffs and protect our businesses from competition. That’s a siren call of surrender, and I won’t go for it. Protectionism never works. It forces prices up. It restricts choices. It kills jobs. Sales there create jobs here, and fighting to get rid of trade restrictions overseas is the best way we can help our companies compete, win and create good jobs right here in North Carolina.

“It’s Washington that is holding us back. Giving bureaucrats more power over the economy is only going to make it worse. The way we bring jobs back to America is to take power out of Washington, give it back to the American people. Through hard work, ingenuity, and know how, we will compete with the world and we will win.

“Secretary Clinton and Mr. Trump may not believe we can do it, but I do.

“A radical change to our tax code like this will mean so much for so many Americans. It will lead to prosperity that everyone will share in. I’m thinking of two folks from South Carolina: Jonathan and Reagan Love. What a great name. Reagan Love. Jonathan serves our nation in the Army National Guard. Reagan’s a school teacher. They’re from Chester, South Carolina but are living in Oklahoma this year while Jonathan’s on duty. This tax plan would save them 2,300 dollars a year, cutting their income tax liability in HALF. And that’s money they would use to open a business when they come back home. For Jonathan, Reagan, and millions of others like you, a plan like this will make all the difference. Making it easier for workers to earn success, and when they do, they will keep more of what they earn.

“It will also help businesses like this one. Morris & Associates makes products that are part of people’s lives – they help cool everything from chickens to nuclear power plants. And it’s a growing company with 100 employees, 70 of them right here in Garner. When you’re a business owner, the federal government is your partner.

“But Uncle Sam only shares in your profit and none of the costs and none of the risk. My plan will make it easier for a business like Bill’s or yours to buy more equipment, hire more workers, and increase wages. Precisely what you all deserve, and precisely what it takes to grow our economy.

“That’s the direction we should move. That’s an aspiration we should share. That’s a goal we can all achieve. And that’s what I will do as your president.

“Thank you.”

https://jeb2016.com/facts-reform-and-growth/

see also: https://jeb2016.com/backgrounder-jeb-bushs-tax-reform-plan/

Facts on the Reform & Growth Act of 2017

Top Line:

- Broad-based tax reform will help create high, sustained economic growth leading to 19 million new jobs and rising middle-class incomes. Cutting high tax rates for American businesses will help us compete with China – and win.

- This plan will eliminate loopholes and carve-outs for special interests in Washington and on Wall Street, and lower rates for American families and small businesses.

- More than 42 million middle class families will get a 33% cut in their income tax rate, and a family of four earning less than $40,000 will face no federal income tax whatsoever.

Rate Reductions:

- Collapse the seven tax brackets into three brackets: 10%, 25%, and 28%.

- Top rate on small businesses will fall from 39.6% to 28% – the lowest since Ronald Reagan.

Special Interests

- To lower rates for families and businesses, we will reduce deductions, carve-outs, and loopholes.

- These provisions reward well-connected Washington and Wall Street insiders rather than American families.

- Eliminating them will make our tax code fairer and our economy more competitive.

- Single individuals earning $8,000 will get an additional $500 earned income tax credit.

- Low-income seniors earning $10,000 will see their after tax-income rise by $620.

- 15 million poor families will no longer pay income taxes

at all:

- A married family of four with incomes below $38,600 would no longer pay income tax.

- Single individuals with incomes below $15,300 would no longer pay income tax.

Middle-Income Americans:

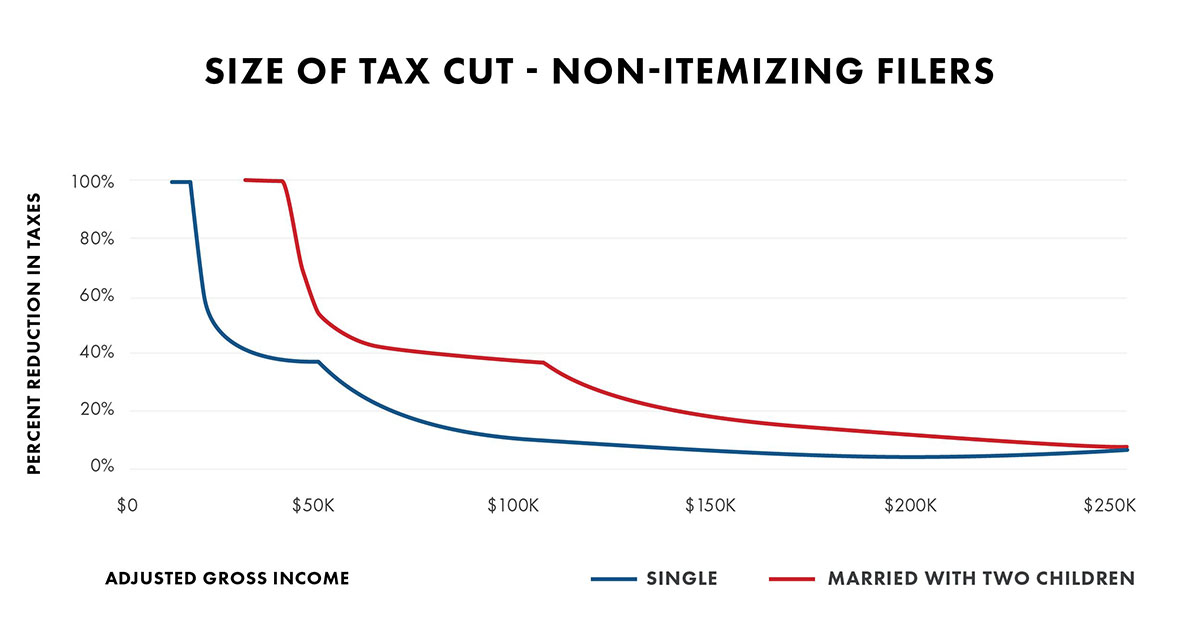

Under Jeb’s plan, more than 42 million middle class families will get a 33% cut in their income tax rate:

- A family of four earning $50,000 will have their taxes cut in half, saving over $1,150 a year.

- A family of four earning $75,000 will have their taxes cut by 40%, saving $2,400 a year.

- A single individual earning $50,000 would have taxes cut by 35%, saving $1,911 a year.

Simplifying Reforms:

- Today, 47 million Americans itemize their deductions. That number will fall to 13 million, resulting in 34 million who will no longer have to file long, complicated tax forms.

- The elimination of the alternative minimum tax means Americans will no longer have to calculate their income taxes twice.

Deductions:

- To support the generosity of the American people, the plan maintains the charitable giving deduction.

- The state and local tax deduction is eliminated to ensure people in low income tax states are no longer forced to subsidize high-tax, high-spending state governments.

- Low-income families will be able to deduct up to 20% of their income while high-income people will only be able to deduct 7% of their income.

Businesses:

- Special-interest deductions for certain industries are eliminated, but businesses will have lower tax rates.

- If a company buys a piece of equipment that increases productivity, they can now write off the cost of that machine immediately, making the U.S. more competitive and creating more jobs.

- Ending the interest deduction for business will mean that government will stop subsidizing corporate and Wall Street debt.

Investment Income:

- Obamacare’s growth-destroying taxes on investment income will be eliminated, returning the capital gains tax rate to 20% – the same rate as under President Clinton.

- Only those putting their own capital at risk will be

able to benefit from the lower rate on investment income.

Other Provisions:

- Death will no longer be a taxable event with the elimination of the estate tax.

- The marriage penalty will be eliminated and secondary earners will face a 0% tax on their first dollar earned when they enter the workforce.

| TaxpayerType | Adjusted Gross Income | Tax Liability Change | Percent Reduction in Taxes | Percent Change in After Tax Income |

| Single No Dependents |

$15,300 | $500 | 100% | 3.2% |

| $25,000 | $774 | 45.4% | 3.3% | |

| $50,000 | $1,911 | 33.4% | 4.3% | |

| $100,000 | $1,911 | 10.5% | 2.3% | |

| $250,000 | $4,431 | 7.1% | 2.4% | |

| Married Two Dependents |

$38,600 | $1,000 | 100% | 2.6% |

| $50,000 | $1,148 | 50.2% | 2.4% | |

| $75,000 | $2,398 | 39.7% | 3.5% | |

| $100,000 | $3,648 | 37.3% | 4.0% | |

| $125,000 | $3,823 | 24.4% | 3.5% | |

| $250,000 | $3,823 | 7.8% | 1.9% |

Jeb 2016

Initial Reactions to Jeb's Tax Cut and Reform Plan

Four economists assessed Jeb’s tax cut and reform plan in the following white paper:Fundamental Tax Reform- An Essential Pillar of Economic Growth

An Assessment of Governor Jeb Bush’s “Reform and Growth Act of 2017”

Steve Moore: The Jeb Bush Tax Plan is Reminiscent of Reagan's Tax Reform

Radio Host Barry Armstrong Praises Jeb Bush's Tax Plan, Might Have Saved New Hampshire Businesses That Left US

https://www.youtube.com/watch?

ARMSTRONG: Lower rates, I like. The elimination of the carried interest I like, and he wants to reduce corporate tax rates, Chuck, from 30 percent down to, 35 percent, excuse me, down to 20 percent. That I think is, you know, it’s tucked away in the story, but I think that is a huge aspect of this because think about how many jobs, how many thousands of really high paying jobs have been lost due to this whole inversion process. Think about Tyco. You know Tyco used to be a big employer in Southern New Hampshire and because of a tax inversion deal, they left the compliment and how many jobs did we lose? How many jobs were lost in the state of New Hampshire as result of that inversion?

Democratic National Committee

What people are saying about Jeb Bush’s tax plan

What’s Jeb Bush’s tax plan? Massive tax cuts for the wealthy and corporations, and exploding the deficit.And remember the failed economic policies of George W. Bush and Mitt Romney? Jeb Bush replicated them today in his plan – and even took a stronger position on wanting the wealthy to pay less.

People are noticing. Read what they’re saying below.

New York Magazine (By Jonathan Chait):

Bush’s plan, unveiled in a Wall Street Journal op-ed, would replicate his brother’s program in extremis. Like Dubya, Jeb would reduce income taxes at the bottom of the earning scale. Dubya reduced the estate tax; Jeb would eliminate it entirely. Dubya cut the top tax rate to 35 percent, while Jeb would lower it all the way to 28 percent. Unlike his brother, he would also slash corporate tax rates, from 28 percent to 20 percent.

Washington Post (By Jim Tankersley):

Bush, like Romney, wants to cut the top rate to 28 percent, from the current 39.6 percent. Romney wanted to cut the corporate rate to 25 percent, and now Bush wants to cut it to 20. Romney wanted to end the estate tax and the alternative minimum tax, which almost exclusively affect higher-income earners. So does Bush.

Both plans proposed to limit tax deductions for the highest earners as a way of reducing their gains from tax cuts - and the effects on the federal budget deficit.

In the end, though, independent analysts found Romney's plan would have given a substantial tax cut to the wealthy. Bush's appears likely to do that, too.

Washington Post (by Paul Waldman):

Jeb Bush released the first details of his tax plan today in a Wall Street Journal op-ed, so we finally learn the secret that will produce spectacular growth, great jobs for all who want them, and a new dawn of prosperity and happiness for all Americans. Are you ready?

It’s…tax cuts for the wealthy!

More Bush, More Bush Tax Cuts. What Could Go Wrong?

Jeb Bush is taking yet another page out of his brother and Mitt Romney's playbook with his tax plan that gives massive handouts to the wealthy -- to prove he's the most fiscally conservative candidate in the field, he's taking their plans even further. Jeb's for cutting the corporate income tax rate to 20% -- as compared with Romney's 25% proposal -- and slashing the the tax on top income earners to 28%, as compared with George W. Bush's 35%. Jeb would also eliminate the estate tax in a proposal his own economists estimate would cost $3.4 trillion over the next decade. Mitt's "revenue neutral" tax plan tanked his campaign... how could Jeb's $3.4 trillion tax plan possibly backfire?And despite Jeb's "populist" framing of his plan, hedge fund managers are getting off relatively unscathed: Sure, Jeb's eliminating the carried interest loophole, but his plan would simultaneously cut top income earners' tax rate by "almost 12 percentage points."

"You could argue the carried interest is a fig leaf compared to the broader tax cuts in the plan,” Matt Gardner, the Institute on Taxation and Economic Policy's executive director, told MSNBC.

At the end of the day, Jeb's plan is nothing more than the Bush Tax Cuts 2.0.

Washington Post: Jeb Bush’s new tax plan could cost $3.4 trillion over next decade

Washington Post: Editorial Board: Jeb Bush’s tax plan doesn’t quite add up

MSNBC: The (new) Bush tax cuts: $3.6 trillion

MSNBC: Jeb’s tax plan makes George W. Bush’s policies look good