- The Second

180 Days « Senate Passes the Tax Cuts and Jobs

Act: Reactions

Reactions to Senate Passage of the Tax Cuts and Jobs Act

December 2, 2017

SUPPORTThe White House

Statement from the Press Secretary on the Tax Cuts and Jobs Act

President Donald J. Trump applauds the Senate for passing the Tax Cuts and Jobs Act. The Senators who voted for these historic tax cuts did a great service to their constituents as they supported putting America first, growing the economy, and rebuilding our great country. The policies in this bill will cut taxes for hardworking families and put our economy on a path of sustainable economic prosperity and job creation. We have a once-in-a-lifetime opportunity to reclaim America’s great destiny. The Administration looks forward to working with Congress to fulfill the promise we made to deliver historic tax cuts for the American people by the end of the year.Republican National Committee

RNC Statement on Senate Passage of the Republican Tax Cut Bill

RATE Coalition

RATE Coalition Statement on Senate Passage of the Tax Cuts and Jobs Act

“We applaud the Senate for seizing this once-in-a-generation opportunity to fix America’s broken tax system – one that punishes job-creating businesses with the highest corporate tax rate in the industrialized world. If enacted, the Tax Cuts and Jobs Act would live up to its name by yielding more jobs and greater investment. As projected by the nonpartisan Tax Foundation, the White House Council of Economic Advisers, and most recently, more than 100 economists from across the country, the TCJA is the key capable of unlocking the enormous economic growth well within our reach. Thanks to the historic resolve displayed by Congress, the American people are now one critical step closer to it.

“While it is important to recognize the significance of this legislative achievement, we must also stay focused on a fight that is not yet finished. As the two chambers now prepare to reconcile the two packages, the House and Senate must work together to send a bill to President Trump’s desk with the degree of swiftness American workers deserve.”

Saturday, December 2, 2017 - 2:00am

U.S. Chamber’s Donohue: Tax Reform Closer Than Ever to Becoming Reality

Pro-Growth Reform Will Grow the Economy, Create Jobs, and Encourage Business Investment

WASHINGTON, D.C. — U.S. Chamber of Commerce President and CEO Thomas J. Donohue issued the following statement today after the U.S. Senate passed the “Tax Cuts and Jobs Act:”“The decades-long drive toward meaningful tax reform is closer than ever to becoming a reality. We applaud the senators who today advanced a legislative package that will grow the economy, create jobs, and allow middle-class Americans to keep more of their hard-earned money. This bill will encourage investment here in the United States as businesses hire workers, expand facilities, and buy new equipment.

“Momentum toward final passage is building rapidly with only a couple critical steps left to complete. Lawmakers are poised to deliver on the promise of a better economic future for all Americans, and I urge them to keep up the good work and finish the job without delay.”

The U.S. Chamber’s Key Vote Letter for the “Tax Cuts and Jobs Act” can be found online here. The Chamber will judge any tax reform package on whether it improves economic growth; its principles for pro-growth tax reform can be viewed here.

NFIB

Small Business Cheers Senate Passage of Tax Reform Plan

Hundreds of billions in tax relief for small business is now within reach, says National Federation of Independent Business (NFIB)

The National Federation of Independent Business (NFIB) issued the following statement today on behalf of President and CEO Juanita Duggan in response to the Senate’s passage of the Tax Cuts and Jobs Act:“We are pleased to see the Senate pass the Tax Cuts and Jobs Act, which will provide significant tax relief to small businesses. We are grateful to Majority Leader McConnell, Chairman Hatch, and all of the senators who supported the measure.

“For small businesses, federal taxes are too high. The tax code is too complicated. Complying with the rules is too costly. According to our research, five of the top 10 problems for small business owners relate to the federal tax code. Tax reform is an economic imperative and it’s one step closer. We urge leaders in the House and Senate to reconcile their respective plans quickly so the President can sign tax reform into law this year.”

For more information about NFIB, please visit www.nfib.com.

Family Research Council

FOR IMMEDIATE RELEASE: December 2, 2017

CONTACT: J.P. Duffy or Alice Chao

Family Research Council Praises Senate Passage of Tax Cuts and Jobs Act

WASHINGTON, D.C. -

Today the Senate passed the Tax Cuts and Jobs Act (H.R. 1). This

legislation is the first major overhaul of the country's tax code in

over thirty years. Family Research Council (FRC) supported the House

passed version of H.R. 1. FRC also announced yesterday plans to score

amendments to the Senate version of the bill. FRC did score in favor of

the Cruz Amendment. FRC intended to score the Daines Amendment, but it

was not offered.

Family Research Council President Tony Perkins released the following statement:

"The Senate now joins the House in approving the most significant tax relief for families in more than three decades. The Tax Cuts and Jobs Act will make it easier for families to thrive and that benefits everyone. Stronger families mean a stronger economy.

"The Senate bill alleviates marriage penalties which are so prevalent in the tax code -- something that's been advocated for decades by Family Research to promote what is the best environment for children. Increasing the child tax credit provides immediate relief for parents and will bolster the economy further as these children become taxpayers one day.

"We supported Senator Daines's effort to apply the child tax credit to unborn children, and are disappointed that procedural hurdles prevented that from happening and also required removal of unborn children from 529 education savings accounts which the House had passed. We think common sense shows that unborn children should qualify for a child tax credit and that moms and dads who begin planning and preparing for their baby should be able to provide for their education as soon as they learn about their pregnancy.

"Passage of Senator Cruz's amendment to allow 529 savings accounts to be applied to homeschooling and K-12 schools is a great victory for the millions of moms and dads who choose to send their child to either a private, religious, or public K-12 schools, or to pay for the expenses associated with homeschooling. We are very grateful to Vice President Mike Pence for breaking the tie vote on this amendment.

"We are confident that when the final bill emerges from conference, that it will also include language repealing the infamous Johnson amendment, a law that has been used by the IRS to intimidate non-profit organizations and churches that speak about policy issues. We are also hopeful the itemizing for charitable deductions will be restored to the final bill.

"Senators Ted Cruz and Steve Daines worked tirelessly on amending this bill to improve it for moms and dads and all their children. Senators Orrin Hatch and Mike Enzi who shepherded this bill through passage deserve praise for their efforts to help the families with this bill. We look forward to President Trump signing the Tax Cuts and Jobs Act into law and giving Americans fuller wallets and freer speech," concluded Perkins.

-30-

Faith & Freedom Coalition

Faith & Freedom Coalition Praises U.S. Senate for Passing Tax Cuts and Jobs Act

Celebrates Doubling of Child Tax

Credit to $2,000, Doubling Standard Deduction, Repealing Obamacare

Mandate

Washington, DC - Faith & Freedom Coalition today praised the U.S.

Senate for passing the Tax Cuts and Jobs Act. “This tax cut is pro-child, pro-jobs, pro-middle-class, and pro-family. By expanding the child tax credit, it strengthens the family and empower parents. By repealing the individual mandate, it takes a giant step toward repealing Obamacare,” said Ralph Reed, founder and Chairman of Faith & Freedom Coalition. “We remain fully committed to repealing the Johnson Amendment restricting the First Amendment freedom of speech of the faith community, a provision contained in the House-passed version of the tax cut. I want to single out for praise Majority Leader McConnell and Finance Committee Chairman Hatch, who worked tirelessly with their colleagues to achieve a consensus and pass this tax cut.”

The tax cut contains the following provisions that Faith & Freedom has strongly supported:

- Doubling the child tax credit to $2,000. An estimated 22 million Americans benefited from the child tax credit in 2015 and it has helped to lift over nine million people out of poverty. This is a $600 billion tax cut targeted directly at middle-class working families that is pro-life, pro-child and pro-family.

- Nearly doubling the standard deduction to $12,000 for individuals and $24,000 for families. This represents nearly a $1 trillion cut in taxes for middle-class families and will protect a larger share of the average family’s income from taxation.

- Repealing the Obamacare individual mandate/tax. An estimated 6.7 million Americans paid this tax in 2015 rather than pay for health insurance they did not want and could not afford.

- Cutting taxes on small businesses and pass-through companies. Small, family-owned businesses create 80 percent of the new jobs in America.

Faith & Freedom Coalition will continue to work with Congressional leaders and the conferees of an anticipated conference committee to iron out the differences between the Senate and House versions and enact final legislation to give the America’s working families the tax cut they so richly deserve.

BREAKING: Senate Passes Tax Reform Bill

A short while ago, the Senate passed its version of a sweeping, once in a generation tax reform bill.

This is a great step closer to achieving major tax reform for the first time in decades.

Senate Republicans demonstrated they have an ability to govern and deliver on long-standing campaign promises. This bill will provide relief to small business, help Americans keep more of their hard-earned dollars, and spur additional economic growth.

Conservatives achieved some huge victories

in this tax proposal:

- Ending Obamacare’s individual mandate penalty;

- Eliminating the SALT subsidies to liberal state and local

governments; and

- Reducing taxes by $1.5 trillion over the next decade.

These were only accomplished because conservatives like you.

But this is not the end -- Heritage Action will continue to work with lawmakers to make sure President Trump can sign a bill into law that spurs economic growth, increases wages for American workers, and creates jobs.

Now, the House and Senate must pass the same exact text. But thanks to your pressure, we are firmly on track to enact this sweeping tax reform plan by Christmas.

Thank you for all that you have done, and will continue to do, in this fight.

Senate Passes Legislation to Open Alaska’s 1002 Area

Reconciliation Bill Will Create Jobs, Generate Revenues, Refill TAPS

WASHINGTON, D.C. – U.S. Sens. Lisa Murkowski, Dan Sullivan, and Rep. Don Young, all R-Alaska, today released the following statements after the Senate passed H.R. 1, the Tax Cuts and Jobs Act, which includes Murkowski’s title opening a small portion of the non-wilderness 1002 Area of the Arctic National Wildlife Refuge (ANWR) for responsible energy development.“Tonight is a critical milestone in our efforts to secure Alaska’s future,” Murkowski said. “Opening the 1002 Area and tax reform both stand on their own, but combining them into the same bill, and then successfully passing that bill, makes this a great day to be an Alaskan. I thank all of the Senators who spent time learning about our opportunities and needs, and who joined us tonight in voting for Alaska. We are grateful for their support and eager to take the next steps for this pro-jobs, pro-growth, and pro-energy legislation.”

“Today’s historic vote is yet another milestone in bringing us that much closer to realizing a decades-long dream of opening the 1002 area of ANWR,” Sullivan said. “Although there is still work to be done, I’m optimistic we will succeed on the merits of our policy and the passion of our people. Allowing development in the coastal plain, an area specifically set aside for exploration and development, is a win for Alaska and a win for the nation. It will create thousands of good paying jobs, restore faith in our economy and drive investments in our communities. It will also help protect the global environment by producing energy at home using the most stringent of environmental standards, and will help strengthen our national security and foreign policy. Going forward, I will continue to work with Senator Murkowski and Congressman Young as a strong team for Alaska to at long last make this a reality for Alaska and the nation.”

“I applaud the Senate for passing this much-needed legislation to reform our tax code and unlock more of Alaska’s energy potential,” Young said. “Alaska is home to a vast amount of natural resources, and through the development of ANWR, we will strengthen our economy by creating new jobs and generating new revenue. I am proud of the work that has been done by our Senators to overcome complex parliamentary hurdles and retain this important language in the bill. As we move forward, particularly through the Conference Committee process, I will work with my House colleagues to ensure Alaska’s interests are protected and our energy sector continues to be a global leader. This is crucial for the economic growth of our state and nation, but also for countless families, communities and small businesses.”

Murkowski is chairman of the Senate Committee on Energy and Natural Resources. Title II of the Tax Cuts and Jobs Act, which was written by Murkowski, establishes an environmentally protective oil and gas development program in the non-wilderness 1002 Area, with two lease sales required over the next ten years. It was reported out of committee on a bipartisan basis on November 15, 2017. Murkowski and Sullivan both voted in support of the reconciliation bill.

Tom Perez on Senate Republicans Passing Middle Class Tax Hikes

DNC Chair Tom Perez released the following statement after Senate Republicans passed their tax plan without a single Democratic vote:“This tax scam is an absolute betrayal of America’s working families. While Senate Republicans allowed virtually no debate or time to even read the hundreds of pages of hastily-drafted, handwritten bill text, they did manage to add dozens of new giveaways to special interest lobbyists. Republicans are unilaterally taking billions of dollars away from the middle class and handing it over to their billionaire donors and wealthy corporations while destroying the future of our economy.

“This is the price of Republican leadership: a tax plan built on lies and written for the rich, by the rich. Voters won’t forget this betrayal on Election Day. And as Republicans continue to turn their backs on the people they’re supposed to represent, Democrats will keep fighting to build an economy that works for everyone.”

American Bridge 21st Century

American Bridge Statement on Passage of the Trump-GOP Tax Scam

Americans for Tax Fairness

STATEMENT on Senate Tax Bill Passage

Main Street Alliance

Senate Republicans Prioritize Wealthy Donors Over

Small Business

WASHINGTON, DC --- More than 1,500 small business owners across the country sent a letter to Congress this week opposing the Republican tax overhaul. With today’s passage of the Senate version of the bill, Amanda Ballantyne, the National Director of Main Street Alliance, a national network of small business owners, issued the following statement:

“The Senate tax bill is a gift to big corporations and the wealthy that comes at the expense of the majority of small business owners and their customers.

The massive, permanent tax break for large

corporations will be paid for by unconscionable cuts to programs that

small business owners and their customers rely on, including Medicare,

Medicaid, and education. Further catering to special interests,

GOP

Senators created new loopholes specifically for Wall Street

investors. If the bill passes, income inequality will grow

more

severe in the next decade, a trend that will be devastating for Main

Street businesses.

If Republicans in Congress really wanted to help small business owners, they would pass policies that invest in our communities and close corporate tax loopholes, making Big Business pay their fair share. Instead, Republicans in Congress have passed a tax bill that demonstrates their desperation to please their donors and score a political win, regardless of the cost to Main Street.”

###

BEFORE THE VOTE

CBO

preliminary estimate of deficit effect, 2018-2027: $1.448 trillion [PDF]

The Concord Coalition

December 1, 2017

Media Contact: Steve Winn

Senate Tax Bill: Too Much Debt, Too Many Gimmicks

WASHINGTON -- The Concord Coalition said today that the tax legislation considered by the Senate is based on flawed economics, reckless fiscal policy and blatant budget gimmickry. It would worsen the nation’s fiscal outlook and introduce new complexities in the tax code at a time when policymakers should be aiming to lower deficits and make the tax code more efficient.

“This is the wrong bill at the wrong time,” said Robert L. Bixby, Concord’s executive director. “Like its counterpart in the House, the Senate’s tax bill is based on the flawed premise that another trillion dollars or more of new debt is needed to spur higher economic growth.”

He added: “The economy does not need short-term stimulus from a major tax cut at this time. And over the long term, adding more debt to the already unsustainable path of current fiscal policies would act as a restraint on future growth. Revenue-neutral tax reform would not have this problem.”

Projections from the Joint Committee on Taxation confirmed Thursday that the bill does not come close to “paying for itself,” even assuming the tax cuts’ impact on economic growth. This is in line with the thinking of most mainstream economists and nonpartisan budget experts.

“In case there were any remaining doubts, the projections of the Joint Committee on Taxation confirm that this tax legislation will add to the federal debt, which is already quite high by historical standards and is expected to rise rapidly in the coming decade,” Bixby said. “Rather than addressing the nation’s difficult challenges, the tax legislation will make those challenges even harder to deal with.”

In addition, Concord reiterated its concerns about the Senate’s hasty process and the use of budgetary gimmicks to hide the size of the additional borrowing that the tax bill will require. The bill has been rushed through so quickly that it is difficult if not impossible for lawmakers and the public to understand everything that is in it. That makes it even harder to see all the gimmicks that threaten even higher deficits.

The House and Senate legislation both rely on various gimmicks to understate the fiscal damage they would do. For example, certain provisions would theoretically be phased out at some point, but some supporters of the bills have made clear that they will want those provisions to eventually be extended, adding hundreds of billions of dollars in costs.

“We need to make sure that tax reform improves long-term economic growth, raises enough revenue to prevent the debt from ballooning, and does not hide costs with gimmicks,” Bixby said. “The current plans fail all those tests.”

“The Senate and House bills have some significant differences that need to be reconciled,” Bixby said. “Lawmakers should use this opportunity to reconsider what’s being done and look for a more responsible approach to overhauling the tax code.”

A copy of this press release can be found here.

The Concord Coalition is a nonpartisan, grassroots organization dedicated to fiscal responsibility. Since 1992, Concord has worked to educate the public about the causes and consequences of the federal deficit and debt, and to develop realistic solutions for sustainable budgets. For more fiscal news and analysis, visit concordcoalition.org and follow us on Twitter: @ConcordC

December 1, 2017

CRFB Reaction to Senate Tax Bill

###

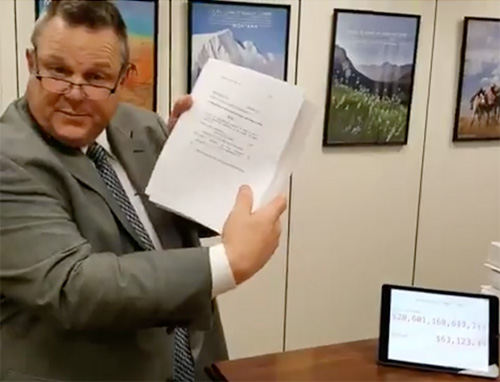

[grabs from video]

U.S. Sen. Claire McCaskill (D-MO)

Tweet 2:29 PM - 1 Dec 2017

This is so bad. We have just gotten list of amendments to be included in bill NOT from our R colleagues, but from lobbyists downtown. None of us have seen this list, but lobbyists have it. Need I say more? Disgusting. And we probably will not even be given time to read them.

MEMORANDUM

To: Interested Parties

From: Robby Mook, Former Campaign Manager, Hillary for

America

Jeff Weaver, Former Campaign

Manager, Bernie Sanders 2016

Date: December 1, 2017

Re: Trump’s Tax Plan Will Doom Republicans in 2018

CONCLUSION

The tax proposal is the best opportunity yet for Democrats to convince voters that Donald Trump and congressional Republicans are looking out for their wealthy donors, and not working-class Americans. The widespread opposition to the Republicans’ plan should reassure Democrats that they ought not engage in some false choice between different groups of voter targets. Our party should compete everywhere, and seek to win over voters of all ages, education backgrounds and income levels by using the tax fight to illustrate the two parties’ vastly different priorities. If Democrats seize this opportunity, congressional Republicans who support the tax plan will definitely be doing so at their own political peril.

Leader McConnell and Speaker Ryan

December 1, 2017

Joint Statement from Leader McConnell and Speaker Ryan on Misleading Democrat Claims About Tax Reform

WASHINGTON, D.C. – Senate Majority Leader Mitch McConnell (R-KY) and House Speaker Paul Ryan (R-WI) released the following statement on misleading Democrat claims that tax reform would lead to cuts in vital programs:

“Critics of tax reform are claiming the legislation would lead to massive, across-the-board spending cuts in vital programs—including a four percent reduction in Medicare—due to the Pay-Go law enacted in 2010. This will not happen. Congress has readily available methods to waive this law, which has never been enforced since its enactment. There is no reason to believe that Congress would not act again to prevent a sequester, and we will work to ensure these spending cuts are prevented.”

Senate Minority Leader Chuck Schumer

November 30, 2017

Schumer Floor Remarks on the Republican Tax Bill

Washington, D.C. – U.S. Senator Chuck Schumer today spoke on the Senate floor regarding the secrecy behind the creation of the Republican tax bill and the future consequences of the bill on the middle class. Below are his remarks which can also be viewed here:Mr. President, later tonight or in the early hours of tomorrow morning, we will vote on the final passage of the Republican tax bill.

I would like to make two main points about the Republican tax bill in my speech this morning: first on process, and second, on the substance.

From the very beginning, the Republican tax bill has made a mockery, a mockery, of the legislative process.

Republican leaders disappeared behind closed doors and negotiated a framework for a tax bill, without a shred of Democratic input. Then Republican leaders wrote a bill, behind closed doors, without a shred of Democratic input. Republicans brought that bill through a markup in the Finance Committee, where it underwent the scrutiny of ONE – I repeat, ONE – expert witness. That’s it. Finance Committee Democrats offered sixty amendments to the bill but Republicans rejected every single one. Committee Republicans made it crystal clear they were not interested in bipartisanship.

Now that bill is before us on the floor. Even further, significant changes likely will be made by the Majority Leader today, he will get huge changes in a bill today and try to vote on it tonight… and this is tax, one of the most complicated issues before us. These changes and the way the Majority Leader is handling this make it impossible for any independent analyst to get a good look at the bill and how it would impact our country.

From the one-sidedness with which it was drafted to the reckless haste with which it was considered – the Republican tax bill has failed to go through anything, anything, resembling the normal legislative process.

Before the night is out, I hope all of my Republican friends ask themselves if this is the way they want history to remember how the first major tax bill was passed in over 30 years. I hope they ask themselves if this process has lived up to the fine traditions of this body, as they were eloquently described by my friends the Senators from Arizona – both senior and junior.

The American people are clamoring for us to work together. They believe our politics is broken. They think our politics is starved of common sense and compromise, and it is. The way this tax bill is being rammed through is exactly why the American people our politics is so broken.

Now let me address the substance of this bill.

Without exaggeration, I believe that if this bill passes, it will be remembered as one of the worst pieces of public policy in decades. A vote for passage will be a vote my Republican friends will regret.

At a time of immense inequality, the Republican tax bill makes life easier on the well-off and eventually makes life more difficult on working Americans, exacerbating one of the most pressing problems we face as a nation -- the yawning gap between the rich and everyone else.

Corporations enjoying record profits get a massive, permanent tax break while over 60% of the middle class will end up paying higher taxes because their benefits expire.

Healthcare premiums will go up 10%, and 13 million fewer Americans will end up having health insurance as a result of repealing the individual mandate.

The CBO said yesterday that even if we passed the Murray-Alexander bill into law, it would have little to no impact on either of those two things.

And when all is said and done, the tax bill will balloon the deficit by at least $1.5 trillion: adding to the debt burden borne by the next generation and diminishing our ability to support the military and invest in our schools, our roads, and in scientific research. Let me just repeat that: the increased deficits caused by this bill will cannibalize support from everything we know is essential to economic growth and a strong middle class, including support for our men and women in uniform.

Ultimately, this deficit-busting tax cut will endanger Social Security, Medicare, and Medicaid, as my friend the Republican Senator from Florida admitted yesterday (when he said higher deficits will mean “instituting changes to Social Security and Medicare for the future”).

So a win today for the GOP would be a very temporary one. It would be enjoyed almost exclusively in the political media that measures who’s up today and down tomorrow but fails to grasp the bigger picture.

It won’t be a long-term win politically; recent polling has shown this tax bill is less popular than previous tax hikes. Let me say that again, recent polling has shown that this tax bill is less popular than previous tax hikes. But more importantly, it won’t be a win out in the country. It won’t be a win for the 13 million middle-class families who pay higher taxes in 2019 or the 87 million middle-class families who pay higher taxes by 2027. It won’t be a win for the single mom in the suburbs, who, no longer able to deduct state and local taxes, will find it that much harder to send her daughter to college. It won’t be a win for the 13 million Americans who will go without health insurance and everyone else who will face 10 percent higher premiums next year.

These hardworking Americans have waited years for their Congress to pass legislation to make things just a little bit easier on them. They’ve watched an economy that for decades rewarded hard work and fair play turn against them, producing more wealth for the already wealthy, but less pay and less work for workers. For so many, this rigged economy that benefits too few and leaves too many behind is a source of frustration and anger and despair.

Donald Trump, in his campaign for the presidency, spoke to that anger. And yet, his tax bill, the Republican tax bill, is a betrayal of the working men and women who feel that anger and would make worse all of the problems that led to it in the first place.

We can do a better job on tax reform, but only if we work together. The way this Congress has careened from partisan bill to partisan bill, with no attempt even made at bipartisanship – has brought shame on this body and reinforced the skepticism that so many Americans have about our politics.

Today, my Republican friends have an opportunity to turn back from this partisan bill and this partisan process. If they do, I guarantee that they will find a Democratic Leader, Democratic Senate Caucus, and a Democratic party that’s eager to work with them on the kind of tax reform our country deserves.

We won’t sit in our corner and make unreasonable demands. As many of my colleagues know, there is a lot of sincere intent on this side of the aisle to do tax reform. I’ve worked with Sen. Hatch, I’ve worked with Sen. Portman, many others of my caucus have worked with Republicans on tax reform ideas for years. We can certainly put together a bill acceptable to both parties that reduces burdens on the middle class, makes our economy more competitive, creates jobs here at home, and do it in a deficit-neutral way.

This bill doesn’t do those things, but we can write a bill that does – together.

I say let’s give it a shot. If my Republican friends close the door on their partisan tax bill tonight, they will find an open door for bipartisan tax reform tomorrow.

Americans Against Double Taxation

November 29, 2017

Coalition Letter To Senate: Maintain Full SALT Deduction

Dear Senator:

We, the undersigned organizations, urge you to maintain the full deduction for state and local taxes (SALT) as part of tax reform legislation. We ask you to support all amendments on the floor to fully restore SALT, if offered. Alternatively, if the full SALT deduction is not preserved in Senate’s tax reform legislation, then we must urge you to vote no on this legislation on final passage as the only means to preserve this longstanding federal policy vital to middle class taxpayers, home values, state and local governments, and the public services in our communities.

Below we outline a number of the concerns we have with the Senate’s proposal to eliminate the entire SALT deduction as part of tax reform. Importantly, none of these concerns would be addressed by restoring the property tax deduction with a $10,000 cap or any changes to the bill that partially eliminate SALT:

- It is fundamentally unfair to eliminate the SALT deduction in whole or part for middle class families while fully preserving this same deduction for corporate tax filers. This unprecedented and disparate treatment creates an unwarranted double standard, giving preference to companies organized to generate profit over individuals and families who make mandatory tax payments to support public services benefiting all citizens. Moreover, the fact that corporations get a significant tax cut under the Senate plan while up to 50% of individual and family filers will get a tax hike, according to the Tax Policy Center, makes this double standard even more troubling.

- Eliminating SALT would result in double taxation of individuals and families for the first time since the creation of the federal tax system.

- Moody’s, the National Association of Realtors, and the Homebuilders all have warned that changes in SALT and the standard deduction also could reduce home values by up to 10%. For many taxpayers, homes represent their largest investment.

- Elimination of SALT also could harm communities depending on state and local tax revenues to support infrastructure, public safety, public schools, and other vital public services that make them safe, enjoyable, and competitive. Moody’s has said eliminating SALT would be a “credit negative for the public finance sector by raising the effective cost of state and local taxes for many taxpayers and reducing disposable income.” Fitch similarly warned the partial elimination of SALT could adversely affect state and local finance decisions. These same concerns have been reported in media coverage quoting a diverse range of state and local officials in Pataskala, Ohio, Conroe, Texas, and San Diego, California, as well as public safety organizations like the Fraternal Order of Police and the National Association of Police Organizations.

- Polls show that voters strongly support retaining the SALT deduction and view the Senate bill with its double standard as benefiting the wealthy over the middle class. Quinnipiac reported that the elimination of SALT was the most unpopular provision among those tested in the tax reform plan, by almost 2-1, 59-30%. Recently, Hart research found support for SALT and opposition to the tax plan is consistent across many so-called “low tax” states, including Maine, Arizona, and Tennessee.

- Finally, adding the House capped property tax deduction to the Senate legislation provides little benefit. A recent analysis by the Institute on Taxation and Economic Policy (ITEP) found 71% of taxpayers who currently claim property tax deductions – and 80% of middle class taxpayers – will lose this deduction entirely under the property tax cap plan. In contrast, wealthy taxpayers would be the biggest winners from the House proposal, as only 13% of those itemizing today would lose their deduction. In short, the property tax deduction effectively would be taken away from nearly 29 million homeowners – almost exclusively in the middle class – under the House or Senate plans, even with the capped property tax deduction.

The deduction for state and local taxes was one of the six deductions allowed under the original tax code when it was enacted in 1913. The full or partial repeal of SALT would upset the carefully balanced fiscal federalism that has existed since the creation of the tax code and expose millions of middle class families to double taxation.

We urge you to preserve deductibility of state and local taxes as an essential, original and vital part of our nation’s tax code, and to oppose the Senate tax reform legislation if SALT is not fully restored.

Thank you.

Sincerely,

AASA, The School Superintendents Association

American Federation of State, County and Municipal Employees

American Federation of Teachers

Association of Educational Service Agencies

Association of School Business Officials, International

Government Finance Officers Association

Independent Sector

International Association of Fire Fighters

International City/County Management Association

National Association of Counties

National Association of Police Organizations

National Association of Realtors

National Council of Nonprofits

National Education Association

National League of Cities

National Rural Education Advocacy Consortium

National Rural Education Association

National School Boards Association

National Sheriffs’ Association

Service Employees International Union

The County of Los Angeles

U.S. Conference of Mayors

CC: U.S. Treasury Secretary Steven Mnuchin

U.S. Senate Majority Leader Mitch McConnell

U.S. Senate Minority Leader Chuck Schumer

U.S. House Speaker Paul Ryan

U.S. House Minority Leader Nancy Pelosi

U.S. House Ways and Means Committee Members

U.S. Senate Finance Committee Members

National Economic Council Chair Gary Cohn

ACORE

ACORE, AWEA, CRES and SEIA Submit Joint Letter Calling on Senate to Repair Provisions that Undermine Renewable Energy in the Senate Tax Bill

WASHINGTON, D.C. Nov. 29, 2017 – The American Council on Renewable Energy (ACORE) together with the American Wind Energy Association (AWEA), Citizens for Responsible Energy Solutions and Solar Energy Industries Associations (SEIA) today submitted a joint letter to the U.S. Senate raising urgent concerns with the Base Erosion Anti-Abuse Tax (BEAT) provisions in the Senate Tax Cuts and Jobs Act. According to these industry leaders, the BEAT program, as currently drafted, would have a devastating impact on renewable energy investment and deployment.

“Renewable tax credits, which are already phasing down, would be subject to a new 100 percent tax under the Senate bill, while the array of tax benefits for fossil fuels, in some cases more than 100 years old, remain untouched,” said ACORE CEO Gregory Wetstone. “If this bill passes as drafted major financial institutions would no longer participate in tax equity financing, which is the principal mechanism for monetizing credits. Almost overnight, you would see a devastating reduction in wind and solar energy investment and development.”

America’s booming renewable energy sector, growing to the tune of $50 billion annually, is one of the nation's most important economic drivers and a critical source of jobs in rural areas where economic opportunity is often otherwise unavailable. If the Senate bill passes as it’s written today, this flourishing industry would suffer massive losses in investment and job creation.

The full letter is available here. The signers are:

- Gregory Wetstone, President & CEO, American Council on Renewable Energy (ACORE)

- Tom Kiernan, CEO, American Wind Energy Association (AWEA)

- Heather Reams, Managing Director, Citizens for Responsible Energy Solutions (CRES)

- Abigail Hopper, Executive Director, Solar Energy Industries Association (SEIA)

###

About ACORE

The American Council on Renewable

Energy (ACORE) is a national non-profit organization leading the

transition to a renewable energy economy. With hundreds of member

companies from across the spectrum of renewable energy technologies,

consumers and investors, ACORE is uniquely positioned to promote the

policies and financial structures essential to growth in the renewable

energy sector. Our annual forums in Washington, D.C., New York and San

Francisco set the industry standard in providing important venues for

key leaders to meet, discuss recent developments, and hear the latest

from senior government officials and seasoned experts. For more

information, visit the ACORE website

and follow @ACORE on

Twitter.

Gil Jenkins

Vice President of Communications