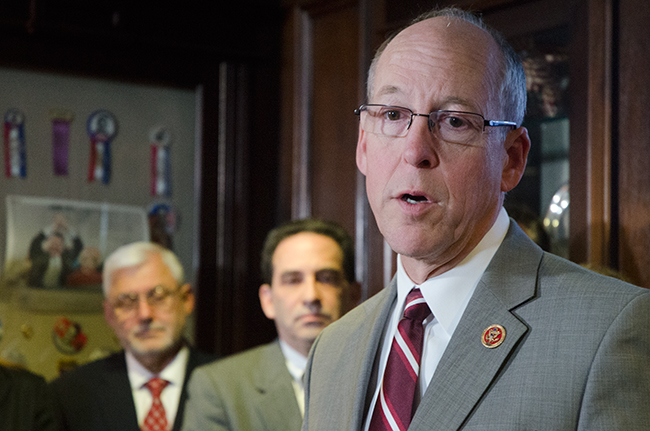

Rep. Greg Walden (R), chairman

of the NRCC, was one of a number of House members who spoke.

RNC Transcript (corrected):

- Hi, I’m Gary Floeter from Cookeville, Tennessee. I’ve been

in business for 45 years, started out the American dream with four

employees and I’ve grown to seventy something employees at this time.

We have always offered major medical coverage to our employees because

we’re looking for the most competitive environment to hire folks. We

want the best of the best. Currently, we have HRA plan, high deductible

plan, which lowers our cost. Under the current administration’s plans

we are being assessed a tax or a fee—define the difference between

a tax or a fee—because we self ensure our deductible. In 2016, the

definition of a small business will be redefined to the federal

standard, in which case we will no longer be to offer the same benefits

we’re offering today. I feel like I’m being punished for providing the

level of care that I have provided to my employees. Why even put a

limit on the deductible? Employees need to have skin in the game. Since

I began business some 45 years ago, right now the uncertainty and the

added expense is creating the inability for me to plan for the future

and on margins that I work with in a mechanical contracting industry

are razor thin, these additional costs are very, very unpredictable. I

would ask, if possible that these provisions be rescinded and we can go

back to being able to offer benefits to our employees unencumbered.

- My name is Diane Hunter and I’m a franchise owner and I own

five offices in Southeastern Ohio. I employee over 300 people. From

2010-2012 my home health business grew by 6%. In 2016, or …in 2013 my

sales declined by 6.5% due to the enforcement of the Affordable Care

Act. Commercial insurances had to reevaluate the

reauthorization process with the Obamacare changes. As a result the

number of visits authorized significantly dropped, causing a serious

financial impact to my company. Fewer patients have been approved under

the Medicaid plan are now being scrutinized for home care services.

There has been no increase in Medicaid reimbursement in my state for

over 10 years. Our Medicare reimbursement has been cut the past two

years

and that’s what we have to look forward to again for the following two

years. So an additionally 4% decrease in Medicare reimbursement. At

this moment, we’re trying to improve care and in order to improve

care, I need to add quality assurance staff, hire more nurses, aides

and therapists to take care of these patients at home. But yet I need

to include these employees in my health insurance plan in order to meet

the requirements of the ObamaCare employer mandate. These are all

additional expenses that are being incurred yet I am being expected to

be reimbursed less and less.

- Good afternoon. My name is Diane Iser; I am from Hoffman

Estates, Illinois and I’m a very grateful 11 year breast cancer

survivor. I had my current policy cancelled October 1st due to

Obamacare

and reinstated December 20th. And I am wondering how I am going to

retain and

keep the doctors who saved my life, at the end of this year, when my

deductible will increase 300 percent, my premium will increase 50

percent, and every time I use the emergency room, whether I've met my

deductable or not, I will pay $500 versus the $75 I pay now.

And I ask, what gives your government the right to move you into

something that is clearly unaffordable.

- I’m Sarah Schulte from Gainesville, Georgia, where I

recently

moved to work for a local faith based nonprofit that does human

trafficking work. And I chose this field because it is something I am

very

passionate about even knowing that I would not be receiving healthcare.

Unfortunately because of ObamaCare I am in a situation now where

to explore all of my options, I'm putting my identify at risk with an

insecure website, and I’m also

concerned about the fact that I will be penalized if I choose, as an

educated

citizen, to not be insured. So those are some of my very

pressing concerns, and I’m in the very demographic that the president

has insisted he is trying to help.

- Good afternoon, my name is Larry Katz and I am from

Metairie, Louisiana. I also have had an opportunity to live the

American dream, starting a small business 18 years ago now and opening

a

chain of diners in the New Orleans area. We’ve offered a full-range of

benefits to our employees from day one, including health insurance,

life insurance, dental, paid vacations, holidays, etc. We were forced

this past December 31st to cancel our health insurance and stop

offering it to all of our employees, including myself, and let everyone

fend for

themselves. The reason why we cancelled it was because had I offered

insurance, none of my employees would have been eligible for a subsidy.

And the sad thing to that is today there are 10 less employees that

have health insurance than had them before Obamacare started at the

beginning of this year. So 10 less people have health insurance.

Additionally, I’m looking to cut costs because starting next year, I’ll

have over a $70,000 penalty and I need to get that money from somewhere

so I need to lower our costs, so I’ll be reducing benefits, I’ll be

reducing staffing, and any plans of expansion is off the table.

- Hi my name’s Aaron Hirsch, I’m from Slidell, Louisiana. I

am an IT contractor. I’m self employed so I’m in the individual

healthcare market. And I had a policy for my family and myself, and I

got a

letter informing me that my policy was being cancelled because it

didn't

meet the minimum requirements for the Affordable Care Act. And the

policy I’ve received as a replacement is now, it's going to cost me 80%

more

in premiums which works out to about $5,500 more a year in premiums

that

I will have to pay for services that I don’t really need and increased

costs that I don’t want to incur.

- Hello, my name is Julie Anderson from St. Cloud,

Minnesota. I’m a family physician in a private practice and I have

concerns about increasing regulations on my practice and as a family

physician, I

just want to take care of patients, that’s all I want to do, and I feel

like over the past few years we’ve had increased burdens and I would

even coin a phrase, “bureaucratization” of my clinic with the

government being in my examination room with my patients. My patients

have

had to travel long ways to see me for visits just to be able to get an

authorization to get a wheeled walker for example. So I would like to

see less regulation in my practice so that I can do the job that I

was trained to do, and that's take good quality patient care at a

reasonable cost.

- Julie Boonstra: Hi. Five years ago I was diagnosed chronic

myelogenous leukemia. At that time I found out that my health insurance

plan was not adequate. So I enrolled in a new plan that fully covered

me. And life has been hard fighting leukemia but my insurance needs

were

met. In October I received a letter telling me that my insurance plan

was being dissolved. I tried to get on the website several times, and

every time it was a failure. For me that means without having insurance

I cannot receive my oral chemotherapy that I need every day in order to

survive. So I ended up enrolling in a private plan where I can at least

get my chemotherapy, but of course I’m paying a higher price now as far

as out of pocket costs and the coverage is just not the same.

- Good Afternoon. My name is Sherri Garner Brumbaugh and I am

President/CEO of Garner Trucking in Finley, Ohio... Our business

started

with one truck with our parents, and now we are at 110 trucks and I

have 160 employees. I am fearful that the Obamacare I will not be able

to provide health insurance for my families, and my families are an

extension of the Garner family. We have been able to provide good

benefits as long as the company has been in existence. I’m fearful that

my competitors will drop their coverage and I will have to do so as

well to stay competitive in the market.

- Hello, my name is Amy Milstead, and I’m from Spring, Texas,

just north of Houston if you know where that’s at. I too am a

second generation business owner; my family has had an automotive

repairs shop collision center and towing center for 41 years. We have

always tried to stay competitive with our competition; we’ve always

tried to offer medical insurance for our employees. Now it is going to

be difficult. We’re experiencing the changes that are going with our

new increases. We are going to renew our policy in July of this year,

and we are already looking at the increases that are coming across the

board. It has caused us to look outside the box; we are looking at self

insured plans, we are looking at partially self insured plans. We don’t

know if this is a time when we need to lay employees off, if we need to

hire more part time employees, how we’re going to pay for this

insurance. We have quit buying the equipment; we are trying to save the

capital towards the medical insurance, all along trying to provide

these things at the demand of meeting the requirements of the lower

deductibles, not going over 9.5% of the employee’s income, no more than

$6,350 out of the pocket for their deductible and their co-pays.

It is

really going to be challenging this year. Thank you for hearing my

story.

|